The year 2024 promises to be a landmark year for the stock market, with several companies preparing to debut through upcoming IPOs in 2024. Initial Public Offerings (IPOs) are an excellent opportunity for investors to get early access to promising businesses and industries. In this guide, we delve into everything you need to know about upcoming IPOs in 2024, helping you plan your investments and stay ahead in the market.

| IPO Name | Dates | Listing Date | Issue Size | Price Band | Lot Size | Listed on |

| Technichem Organics IPO | 31 Dec 2024 – 2 Jan, 2025 | 7 Jan, 2025 | ₹25.25 Cr | ₹52 to ₹55 | 2,000 | BSE, SME |

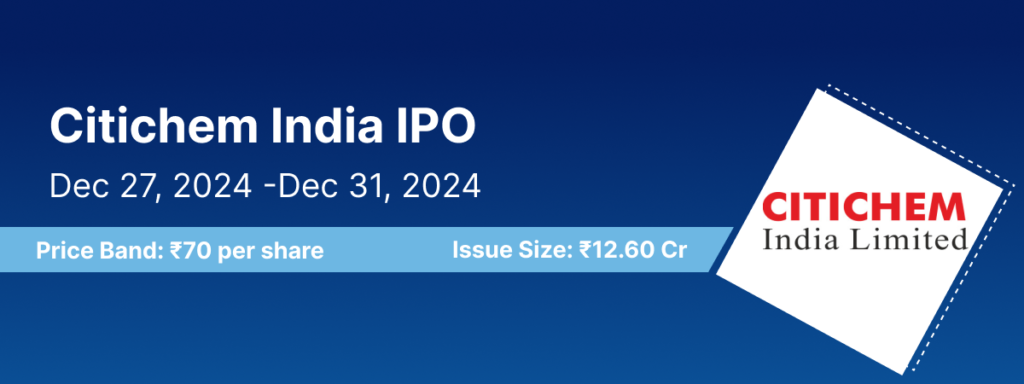

| Citichem India IPO | 27 – 31 Dec, 2024 | 3 Jan, 2025 | ₹12.60 Cr) | ₹70 per share | 2,000 | BSE, SME |

| Indo Farm Equipment IPO | 30 Dec 2024 – 2 Jan, 2025 | 7 Jan, 2025 | ₹260.15 Cr | ₹204 to ₹215 | 69 | BSE, NSE |

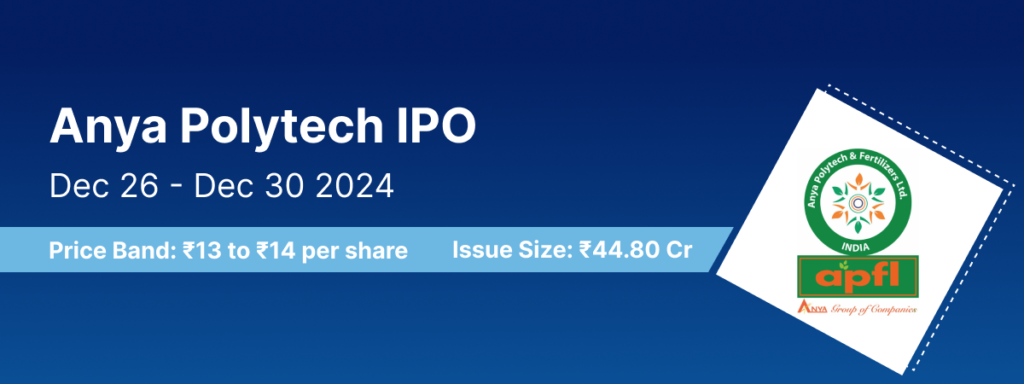

| Anya Polytech IPO | 26 – 30 Dec, 2024 | 2 Jan, 2025 | ₹44.80 Cr | ₹13 to ₹14 | 10,000 | BSE, SME |

| Solar91 Cleantech IPO | 23 – 26 Dec, 2024 | 31 Dec, 2024 | ₹106 Cr | ₹185 to ₹195 | 600 | BSE, SME |

| Unimech Aerospace IPO | 23 – 26 Dec, 2024 | 31 Dec, 2024 | ₹500 Cr | ₹745 to ₹785 | 19 | BSE, NSE |

| Carraro India IPO | 20 – 24 Dec, 2024 | 30 Dec, 2024 | ₹1,250 Cr | ₹668 to ₹704 | 21 | BSE, NSE |

Why Focus on Upcoming IPOs in 2024?

As global markets recover and stabilize, upcoming IPOs in 2024 are set to offer diverse opportunities across various sectors such as technology, healthcare, finance, renewable energy, and consumer goods. Many of these IPOs come from high-growth startups and established companies planning to scale their operations. By staying updated, you can align your investment strategy with market trends and gain early access to potential multi-baggers.

Benefits of Tracking Upcoming IPOs

Tracking upcoming IPOs allows investors to plan their strategies effectively. It provides insights into which sectors are attracting the most attention and capital, helping you diversify your portfolio. Whether you’re a retail investor, institutional buyer, or high-net-worth individual, knowing the timeline, price band, and lot size of an IPO helps you make informed decisions. Even if you don’t participate immediately, monitoring IPO performance can provide a better understanding of market trends and company valuations, offering a roadmap for future investments.

Key Information About Upcoming IPOs in 2024

When considering upcoming IPOs, it’s important to analyze key details to make informed investment decisions. Start by reviewing the company’s Draft Red Herring Prospectus (DRHP), which provides essential insights about the business, its objectives, financial performance, and risk factors. Pay attention to details such as the IPO opening and closing dates, price band, and lot size. Additionally, research the company’s industry position, growth prospects, and management team to gauge its potential. Knowing whether the IPO is listed on NSE, BSE, or SME exchanges can also influence your investment strategy.

How to Choose the Right IPO to Invest In

Choosing the right IPO requires a mix of research and market awareness. Begin by evaluating the company’s fundamentals, such as revenue growth, profitability, and market share. Assess the industry’s overall health and future potential, as some sectors may be poised for faster growth. Consider the utilization of funds outlined in the DRHP to determine whether the company’s plans align with your investment goals. Lastly, monitor market sentiment, as investor demand can often provide valuable clues about an IPO’s potential performance post-listing.

Top Sectors to Watch in 2024

As we look at upcoming IPOs in 2024, several sectors stand out for their growth potential. The technology sector continues to dominate, with numerous startups leveraging AI, cloud computing, and fintech innovation. Healthcare is another promising area, particularly with advancements in biotechnology and telemedicine. Renewable energy and electric vehicles are expected to attract significant attention due to global sustainability efforts. Additionally, the consumer goods and retail sectors, driven by rising disposable incomes and shifting consumption patterns, remain strong contenders for investor interest.

How to Apply for Upcoming IPOs in 2024

Applying for an IPO has become easier than ever, thanks to advancements in technology and streamlined processes. Investors can apply through their Demat accounts using UPI-based platforms or net banking via the Application Supported by Blocked Amount (ASBA) facility. Once you identify a suitable IPO, ensure your application aligns with the price band and lot size. Keep track of the allotment dates to know whether your bid was successful and prepare for the listing day, where stock prices often experience significant volatility.

Risks Associated with IPO Investments

While IPOs offer high potential returns, they come with inherent risks. Newly listed companies may face price volatility, especially if market conditions are unfavorable. Some IPOs may be overvalued, leading to underperformance post-listing. It’s crucial to understand the risks outlined in the DRHP and assess whether the investment fits your risk appetite. Diversifying your portfolio and not over-allocating funds to a single IPO can help mitigate these risks.

Recent Trends in the IPO Market

The IPO market in India has seen a surge in retail participation in recent years, driven by user-friendly platforms and increased financial literacy. In 2024, this trend is expected to continue, with more retail investors eyeing upcoming IPOs for wealth creation. High-profile listings, including those from unicorn startups, are anticipated to attract significant attention. The focus on sectors like technology, healthcare, and renewable energy reflects broader global trends, indicating a maturing market that caters to both traditional industries and emerging players.