When planning to purchase a product or service through financing options, it’s important to understand how much you’ll need to pay every month. One of the most helpful tools for this is an EMI Calculator. But what is an EMI Calculator? Simply put, an EMI (Equated Monthly Installment) Calculator is a tool that helps you calculate the monthly payments you would need to make when you take a loan. It considers the principal loan amount, interest rate, and tenure, giving you a clear picture of how much you’ll be paying each month.

In India, EMI payments are a common way to repay loans, especially for personal loans, home loans, car loans, or even for purchasing gadgets on installment. Understanding the EMI structure is important for borrowers to plan their finances better. With the help of an EMI Calculator, individuals can easily plan their budget, ensuring they can comfortably pay the loan without facing financial strain. In this article, we will discuss in detail what an EMI Calculator is, how it works, and how it can help you make informed decisions about loans.

Basic EMI Calculator

Understanding EMI and the Need for an EMI Calculator

To understand what is an EMI Calculator fully, it's essential to first understand the concept of EMI. EMI stands for Equated Monthly Installment, which is the fixed amount of money that a borrower pays to the lender every month. This amount is made up of both the principal and interest components, and the goal is to clear the loan amount within the stipulated tenure.

EMIs are applicable to various loans like:

- Home Loans: Loans taken to buy or build a house.

- Car Loans: Loans for purchasing a car.

- Personal Loans: Unsecured loans that do not require collateral.

- Education Loans: Loans taken to finance higher education.

Without proper planning, repaying these loans can become a challenge. This is where an EMI Calculator comes in handy, offering an easy and quick way to assess your monthly repayment amount. Whether you are borrowing money for a home, car, or a personal loan, the EMI Calculator gives you an understanding of the financial commitment involved.

How Does an EMI Calculator Work?

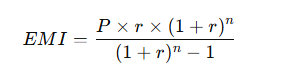

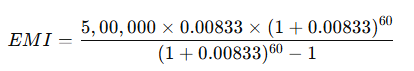

Now that you know what an EMI Calculator is, let’s dive deeper into how it works. The calculator uses a simple mathematical formula to compute the EMI. The formula for calculating EMI is:

Where:

- P = Principal loan amount

- r = Monthly interest rate (annual interest rate / 12)

- n = Number of monthly installments or loan tenure (in months)

Example to Understand the EMI Formula:

Let’s assume you are taking a loan of ₹5,00,000 at an interest rate of 10% annually, with a loan tenure of 5 years (60 months).

- Principal Loan Amount (P) = ₹5,00,000

- Annual Interest Rate = 10%

- Monthly Interest Rate (r) = 10% / 12 = 0.00833

- Loan Tenure (n) = 60 months

Plugging these values into the formula:

This will give you the EMI value, which will be approximately ₹10,624 per month.

So, if you take a loan of ₹5,00,000 at an interest rate of 10% for 5 years, your monthly EMI would be ₹10,624.

This is a simplified example to help you understand how the EMI Calculator functions. It factors in both the loan principal and the interest rate to give you the monthly EMI that you will have to pay.

This will give you the EMI value, which will be approximately ₹10,624 per month.

So, if you take a loan of ₹5,00,000 at an interest rate of 10% for 5 years, your monthly EMI would be ₹10,624.

This is a simplified example to help you understand how the EMI Calculator functions. It factors in both the loan principal and the interest rate to give you the monthly EMI that you will have to pay.

Factors Affecting EMI Calculations

While using the EMI Calculator, it’s important to consider several factors that will influence the final EMI amount:

- Principal Loan Amount: The larger the loan amount, the higher your EMI will be.

- Interest Rate: A higher interest rate results in higher EMIs.

- Loan Tenure: A longer tenure results in lower EMIs but will increase the total amount paid over the life of the loan.

- Processing Fees and Other Charges: Lenders may charge processing fees, which could slightly impact the total amount you need to repay.

Tips for Lowering Your EMI

If you feel that the EMI amount calculated is higher than you can afford, here are a few ways to reduce it:

- Opt for a Longer Tenure: While this will lower your monthly EMI, it may increase the total interest paid over the life of the loan.

- Negotiate the Interest Rate: If possible, try to secure a lower interest rate to reduce the overall EMI.

- Make a Larger Down Payment: If you're purchasing a product, paying a higher down payment reduces the loan amount and, in turn, the EMI.

- Consider Prepayment: Some lenders allow part-prepayment or full prepayment of the loan. Prepaying part of the loan reduces the outstanding principal and lowers your EMI.

In conclusion, an EMI Calculator is an invaluable tool that helps individuals in India understand their monthly repayment obligations when taking a loan. By using this tool, you can make better financial decisions, compare loan options, and avoid financial strain in the future. Whether you’re looking to buy a house, a car, or anything else on credit, an EMI Calculator will give you the clarity you need to plan your finances effectively.

FAQs: What is an EMI Calculator?

What is the benefit of using an EMI Calculator?

An EMI Calculator helps you understand the exact amount you’ll pay each month. It allows you to plan your budget and compare different loan offers.

Can I calculate EMI for any type of loan using an EMI Calculator?

Yes, EMI Calculators can be used for various types of loans including home loans, car loans, personal loans, and education loans.

Is the EMI Calculator available on all loan websites?

Yes, most banks and financial institutions provide EMI Calculators on their websites. You can also use third-party financial websites for this purpose.

Does the EMI Calculator include processing fees?

Typically, the EMI Calculator does not include processing fees, as it calculates only the loan principal and interest rate. However, you can add any processing fees manually to get a more accurate repayment figure.

How does loan tenure affect my EMI?

A longer loan tenure generally results in lower monthly EMIs, but it increases the total interest paid over the life of the loan. A shorter tenure results in higher EMIs but less total interest.

Can I change my EMI amount after I’ve taken the loan?

Once your EMI is fixed, it generally remains the same. However, some lenders offer the option to modify your EMI by altering the loan tenure or interest rate, or through part-prepayment.

What is the best brokerage calculator in India?

It depends on your broker. Popular brokers like Zerodha, Upstox, and Angel Broking offer excellent calculators tailored to their pricing models.