An FD Calculator, or Fixed Deposit Calculator, is an online tool designed to help individuals estimate the returns on their fixed deposit investments. Fixed Deposits (FDs) are a popular savings instrument in India, known for their safety and predictable returns. With an FD Calculator, you can determine how much interest you will earn on your investment and the total amount you will receive at maturity.

This tool is especially useful for Indian investors who wish to plan their finances effectively. By entering details such as the investment amount, tenure, and applicable interest rate, you can get instant results, making it easier to compare different FD schemes offered by banks and financial institutions.

Basic FD Calculator

FD Calculator

Results:

Why Do You Need an FD Calculator?

Investors often find it challenging to calculate returns manually, especially when FDs have varying interest rates, compounding frequencies, and tenures. An FD Calculator simplifies this process by offering:

- Quick Results: Instant calculations without the need for complex formulas.

- Accuracy: Eliminates errors that can occur in manual calculations.

- Comparison: Helps in comparing FDs from different banks and choosing the best option.

- Future Planning: Assists in planning your financial goals with clarity on expected returns.

How Does an FD Calculator Work?

The FD Calculator uses the formula for compound interest to compute returns. Depending on whether the FD pays interest at regular intervals or on maturity, the formula used can vary.

Formula for FD Maturity Amount:

For compound interest:

Where:

- A = Maturity amount

- P = Principal amount (your initial deposit)

- r = Annual interest rate (in decimal form)

- n = Number of times interest is compounded in a year

- t = Tenure of the deposit (in years)

For simple interest:

Steps to Use an FD Calculator

- Enter Principal Amount: The amount you wish to deposit.

- Select Tenure: Duration for which the deposit will be held (e.g., 1 year, 5 years).

- Input Interest Rate: The rate offered by the bank or financial institution.

- Choose Compounding Frequency: Monthly, quarterly, half-yearly, or yearly compounding.

- View Results: The calculator will display the maturity amount and the total interest earned.

Example to Understand an FD Calculator

Let’s consider an example to understand how an FD Calculator works:

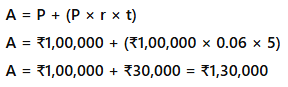

Scenario 1: Simple Interest Calculation

You deposit ₹1,00,000 for 5 years at an annual interest rate of 6%. The bank uses simple interest.

Using the formula:

Maturity Amount: ₹1,30,000

Interest Earned: ₹30,000

Scenario 2: Compound Interest Calculation (Quarterly)

You deposit ₹1,00,000 for 5 years at an annual interest rate of 6%, compounded quarterly.

Using the formula:

Maturity Amount: ₹1,34,685

Interest Earned: ₹34,685

Benefits of Using an FD Calculator

- Financial Clarity: Understand your returns before investing.

- Customizable Inputs: Adjust tenure, interest rate, or amount to see how returns vary.

- No Guesswork: Eliminates the need to rely on bank executives for approximations.

- User-Friendly: Intuitive interfaces on most banking websites and financial apps.

- Accessible Anywhere: Available online, anytime, and often free of cost.

Where Can You Find an FD Calculator?

Most Indian banks and financial institutions offer FD Calculators on their websites or mobile apps. These tools are also available on third-party financial platforms like:

- SBI FD Calculator

- HDFC FD Calculator

- ICICI FD Calculator

- Axis Bank FD Calculator

- Online tools from websites like Moneycontrol or BankBazaar

Factors Affecting Your FD Returns

- Principal Amount: Higher investments lead to higher returns.

- Tenure: Longer durations generally offer better interest rates.

- Interest Rate: Varies based on the bank, tenure, and economic conditions.

- Compounding Frequency: More frequent compounding results in higher returns.

Comparing FD Returns with an FD Calculator

Consider two banks offering the following schemes:

- Bank A: 5.5% annual interest, compounded quarterly, for 3 years.

- Bank B: 6% annual interest, compounded yearly, for 3 years.

Using the FD Calculator, you find:

- Bank A returns: ₹1,17,120

- Bank B returns: ₹1,18,080

Although Bank A offers quarterly compounding, Bank B’s higher interest rate yields better returns.

Limitations of FD Calculators

- Does Not Include Tax: The calculator doesn’t account for TDS or income tax on interest.

- Excludes Inflation: Real returns may be lower due to inflation.

- Fixed Assumptions: Assumes rates remain constant throughout the tenure.

By understanding how an FD Calculator works, Indian users can make informed decisions, ensuring their investments align with financial goals. Always compare rates and terms to maximize your FD returns!

FAQs of FD Calculators

What is an FD Calculator?

An FD Calculator is an online tool that helps estimate the maturity amount and interest earned on fixed deposit investments.

Are FD Calculators accurate?

Yes, FD Calculators provide accurate results based on the input values. However, actual returns may vary due to taxes or changes in rates.

Can I use an FD Calculator for tax-saving FDs?

Yes, the FD Calculator can estimate returns for tax-saving FDs with a 5-year lock-in period.

Do FD Calculators account for TDS?

No, FD Calculators do not deduct TDS or other taxes. You need to account for these separately.

Is the FD Calculator free to use?

Yes, FD Calculators provided by banks and financial platforms are usually free.

What information is required to use an FD Calculator?

You need to enter the principal amount, tenure, interest rate, and compounding frequency.

Does the FD Calculator work for recurring deposits (RDs)?

No, RDs require a separate RD Calculator as the investment pattern is different.