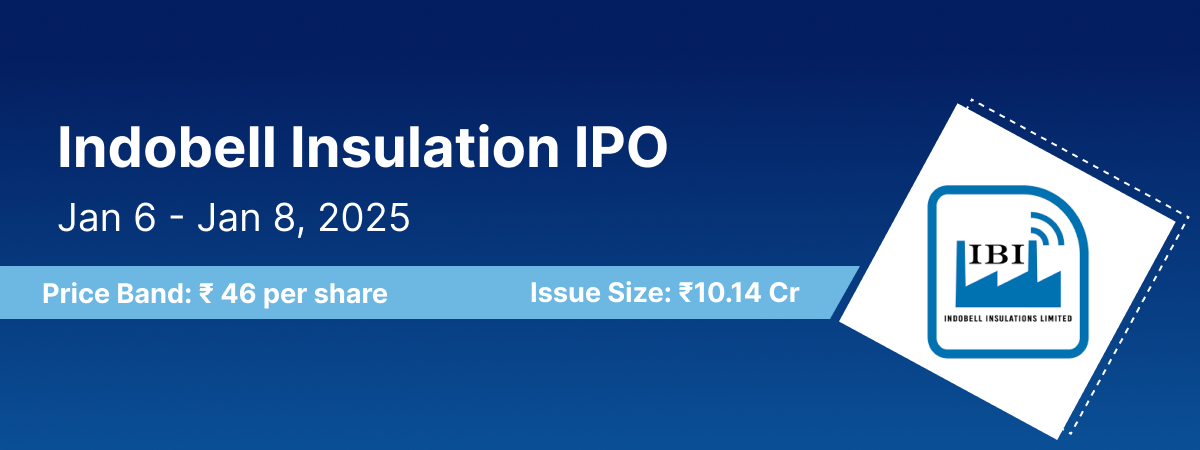

The Indobell Insulation IPO is a fixed-price offering aiming to raise ₹10.14 crores through the issuance of 22.05 lakh fresh equity shares. The subscription period runs from January 6 to January 8, 2025, with the allotment of shares expected to be finalized on January 9, 2025. The IPO is priced at ₹46 per share, with a minimum application size of 3,000 shares, requiring a retail investment of ₹1,38,000. High Net-worth Individuals (HNIs) need to apply for at least two lots (6,000 shares) amounting to ₹2,76,000. The shares are scheduled to list on the BSE SME platform on January 13, 2025.

Finshore Management Services Limited is the book-running lead manager, Integrated Registry Management Services Private Limited serves as the registrar, and Black Fox Financial Private Limited is the market maker for the IPO. Refer to the Indobell Insulation IPO RHP for detailed information.

Indobell Insulation IPO Details

| IPO Date | January 6, 2025 to January 8, 2025 |

| Face Value | ₹10 per share |

| Price | ₹ 46 per share |

| Lot Size | 3,000 Shares |

| Total Issue Size | 22,05,000 shares (aggregating up to ₹10.14 Cr) |

| Fresh Issue | 22,05,000 shares (aggregating up to ₹ 10.14 Cr) |

| Issue Type | Fixed Price Issue IPO |

| Listing At | BSE SME |

| Share Holding Pre Issue | 40,94,952 shares |

| Share Holding Post Issue | 62,99,952 shares |

| Market Maker Portion | 1,11,000 shares |

Indobell Insulation IPO Timeline

The Indobell Insulation IPO opens for subscription on January 6, 2025, and closes on January 8, 2025. For more detailed information, please refer to the Indobell Insulation IPO RHP.

| IPO Open Date | Monday, January 6, 2025 |

| IPO Close Date | Wednesday, January 8, 2025 |

| Basis of Allotment | Thursday, January 9, 2025 |

| Initiation of Refunds | Friday, January 10, 2025 |

| Credit of Shares to Demat | Friday, January 10, 2025 |

| Listing Date | Monday, January 13, 2025 |

Indobell Insulation IPO Lot Size

Investors in the Indobell Insulation IPO can bid for a minimum of 3,000 shares and in multiples thereof. The table below illustrates the minimum and maximum investment requirements for retail investors and High Net-worth Individuals (HNIs):

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 3000 | ₹1,38,000 |

| Retail (Max) | 1 | 3000 | ₹1,38,000 |

| HNI (Min) | 2 | 6,000 | ₹2,76,000 |

Indobell Insulation IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Retail Shares Offered | 50% of the Net Issue |

| Other Shares Offered | 50% of the Net Issue |

About Indobell Insulation Limited

Founded in May 1972, Indobell Insulation Limited is a trusted name in the insulation industry, offering a diverse range of high-quality products such as nodulated wool, granulated wool, and prefabricated thermal insulation jackets. With over five decades of expertise, the company serves residential, commercial, and industrial sectors, delivering customized and efficient insulation solutions.

Comprehensive Product Range

- Nodulated and Granulated Wool:

- Ceramic Fiber Nodules

- Mineral Fiber Nodules

- Prefabricated Thermal Insulation Jackets: Tailored for superior thermal efficiency.

Indobell specializes in customized insulation solutions, offering unique sizes, shapes, and densities. They support projects with 2D/3D designs, manufacturing drawings, and thermal analysis, ensuring precision and client satisfaction.

State-of-the-Art Manufacturing Facilities

Indobell operates cutting-edge manufacturing units in West Bengal and Maharashtra, adhering to the highest industry standards. Their certifications include:

- ISO 9001:2015: Quality Management System

- ISO 14001:2015: Environmental Management System

- ISO 45001:2018: Occupational Health & Safety

Why Choose Indobell Insulation Limited?

- Experienced Leadership: A skilled management team ensures efficient decision-making.

- Operational Excellence: Seamless production processes for timely delivery.

- Advanced Infrastructure: Well-established facilities for manufacturing high-quality products.

- Certified Quality: ISO-certified operations underline the commitment to quality and safety.

- Diverse Product Portfolio: A wide range of insulation solutions catering to various needs.

- Eco-Friendly Practices: Compliance with environmental standards for sustainable operations.

As of December 30, 2024, Indobell employs 31 skilled professionals, supporting its growth and innovation.

Indobell Insulation Limited: Your Partner for Insulation Excellence

Whether you need standard or customized solutions, Indobell Insulation Limited offers products that meet your specific needs. Backed by decades of expertise, certified processes, and a commitment to excellence, Indobell is the go-to choice for insulation products.

FAQS –

What is the Indobell Insulation IPO?

The Indobell Insulation IPO is a fixed-price offering of ₹10.14 crores, comprising 22.05 lakh fresh equity shares. The IPO aims to raise funds for business expansion and other corporate purposes.

What are the dates for the Indobell Insulation IPO?

- Opening Date: January 6, 2025

- Closing Date: January 8, 2025

What is the price of the Indobell Insulation IPO?

The IPO is priced at ₹46 per share.

What is the lot size for the Indobell Insulation IPO?

- Minimum Lot Size: 3,000 shares

- Minimum Investment (Retail): ₹1,38,000

- HNI Minimum Investment: 6,000 shares (2 lots) for ₹2,76,000

What is the tentative listing date of the Indobell Insulation IPO?

The shares are expected to list on the BSE SME platform on January 13, 2025.

When will the allotment of shares be finalized?

The share allotment is expected to be completed by January 9, 2025.