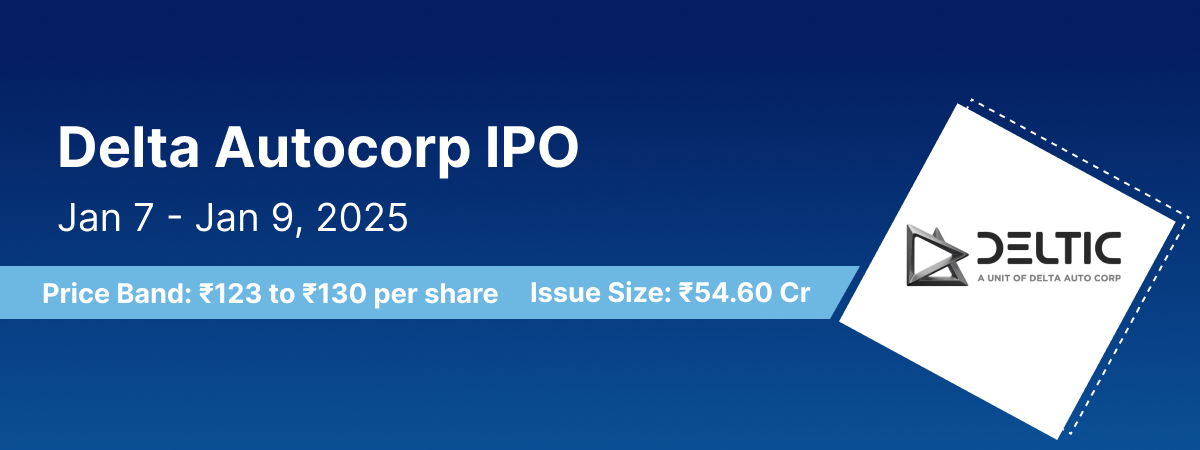

The Delta Autocorp IPO is a book-built issue valued at Rs 54.60 crores. This includes a fresh issue of 38.88 lakh shares worth Rs 50.54 crores and an offer for sale of 3.12 lakh shares amounting to Rs 4.06 crores.

Scheduled to open on January 7, 2025, and close on January 9, 2025, the Delta Autocorp IPO is an exciting investment opportunity. The allotment process will be finalized on Friday, January 10, 2025. The listing of the Delta Autocorp IPO is set for the NSE SME platform with a tentative date of January 14, 2025.

The IPO’s price band has been set between ₹123 and ₹130 per share. Retail investors must invest a minimum of ₹1,30,000, which corresponds to a minimum lot size of 1000 shares. High Net-Worth Individuals (HNIs) are required to apply for a minimum of 2 lots (2000 shares), which amounts to ₹2,60,000.

GYR Capital Advisors Private Limited is the book running lead manager for the IPO, while Link Intime India Private Ltd serves as the registrar. Giriraj Stock Broking Private Limited acts as the market maker for the IPO.

For more detailed information, refer to the Delta Autocorp IPO RHP (Red Herring Prospectus).

Delta Autocorp IPO Details

| IPO Date | January 7, 2025 to January 9, 2025 |

| Face Value | ₹10 per share |

| Price Band | ₹123 to ₹130 per share |

| Lot Size | 1,000 Shares |

| Total Issue Size | 42,00,000 shares (aggregating up to ₹54.60 Cr) |

| Fresh Issue | 38,88,000 shares (aggregating up to ₹ 50.54 Cr) |

| Offer for Sale | 3,12,000 shares of ₹10 (aggregating up to ₹4.06 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share Holding Pre Issue | 1,14,01,698 shares |

| Share Holding Post Issue | 1,52,89,698 shares |

| Market Maker Portion | 2,94,000 shares |

Delta Autocorp IPO Timeline

The Delta Autocorp IPO opens for subscription on January 7, 2025, and closes on January 9, 2025.

| IPO Open Date | Tuesday, January 7, 2025 |

| IPO Close Date | Thursday, January 9, 2025 |

| Basis of Allotment | Friday, January 10, 2025 |

| Initiation of Refunds | Monday, January 13, 2025 |

| Credit of Shares to Demat | Monday, January 13, 2025 |

| Listing Date | Tuesday, January 14, 2025 |

Delta Autocorp IPO Lot Size

Investors can place bids for a minimum of 1000 shares, with additional bids in multiples of 1000 shares. The table below provides details on the minimum and maximum investments for both retail investors and HNI investors, in terms of shares and amounts:

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1000 | ₹1,30,000 |

| Retail (Max) | 1 | 1000 | ₹1,30,000 |

| HNI (Min) | 2 | 2,000 | ₹2,60,000 |

Delta Autocorp IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50% of the Net Issue |

| Retail Shares Offered | Not less than 35% of the Net Issue |

| NII (HNI) Shares Offered | Not less than 15% of the Net Issue |

About Delta Autocorp Limited

Founded in 2016, Delta Autocorp Limited is engaged in the manufacturing and sale of electric 2-wheelers and 3-wheelers (EVs). The company operates under the brand name “Deltic”, initially focusing on electric 3-wheelers. A major milestone was achieved in 2017 with the launch of their first E-Rickshaw, which offered an impressive mileage of over 150 km.

Expansion into 2-Wheelers

Recognizing market trends and evolving customer preferences, Delta Autocorp expanded its product offerings to include electric 2-wheelers. In 2018, the company began developing prototypes for these vehicles and, in 2019, successfully launched affordable and durable electric scooters specifically targeting tier-2 and tier-3 towns.

Widespread Distribution Network

The company operates through a robust network of over 300 dealers across 25 states and Union Territories, with a primary focus on B2B transactions. Their ambition is to establish Delta Autocorp as a global brand, offering cost-effective, practical products backed by excellent service.

Product Range

Delta Autocorp offers a wide array of electric vehicles and components, including:

- Electric 2-Wheelers: Deltic Drixx, Deltic Trento

- Electric 3-Wheelers:

- E-Rickshaws: Deltic Star, Deltic Vayu

- Loaders

- Garbage Carts

- Spare Parts & Accessories: 3W Controllers, 3W Motors

In-House R&D and Innovation

The company emphasizes in-house innovation through its R&D department based in Uttar Pradesh. With a team of 11 dedicated employees, they focus on designing electric vehicles that cater to customer needs and preferences. As of October 31, 2024, Delta Autocorp has grown to employ 139 people.

Competitive Strengths

Delta Autocorp’s growth and success are driven by several key competitive advantages:

- Experienced Promoters and Management Team

- Customer-Centric Approach

- In-House Research and Development

- Effective Distribution Model

- Appealing to the Mass Premium Segment

- Adherence to Quality Standards and Certifications

- Diversified Product Range

Delta Autocorp remains focused on product innovation, quality, and customer satisfaction, aiming to capture a larger share of the growing electric vehicle market.

FAQ –

What is the Delta Autocorp IPO?

The Delta Autocorp IPO is a book-built issue of Rs 54.60 crores. It comprises a fresh issue of 38.88 lakh shares aggregating to Rs 50.54 crores and an offer for sale of 3.12 lakh shares worth Rs 4.06 crores.

When does the Delta Autocorp IPO open and close?

The Delta Autocorp IPO opens for subscription on January 7, 2025, and closes on January 9, 2025.

What is the price band for the Delta Autocorp IPO?

The price band for the Delta Autocorp IPO has been set at ₹123 to ₹130 per share.

What is the minimum lot size for investment in the Delta Autocorp IPO?

The minimum lot size for retail investors is 1000 shares, with an investment amount of ₹1,30,000.

What is the minimum investment amount for retail and HNI investors?

- Retail investors: The minimum investment amount is ₹1,30,000 for 1000 shares.

- HNI investors: The minimum investment amount is ₹2,60,000 for 2000 shares (2 lots).

How can I apply for the Delta Autocorp IPO?

You can apply for the Delta Autocorp IPO through your stockbroker or by using online IPO platforms available through registered banks and financial institutions.

What is the allotment date for the Delta Autocorp IPO?

The allotment for the Delta Autocorp IPO will be finalized on January 10, 2025.

When will the Delta Autocorp IPO be listed?

The Delta Autocorp IPO is expected to be listed on January 14, 2025 on the NSE SME platform.

Who is the lead manager for the Delta Autocorp IPO?

The book running lead manager for the Delta Autocorp IPO is GYR Capital Advisors Private Limited.

Who is the registrar for the Delta Autocorp IPO?

The registrar for the Delta Autocorp IPO is Link Intime India Private Ltd.