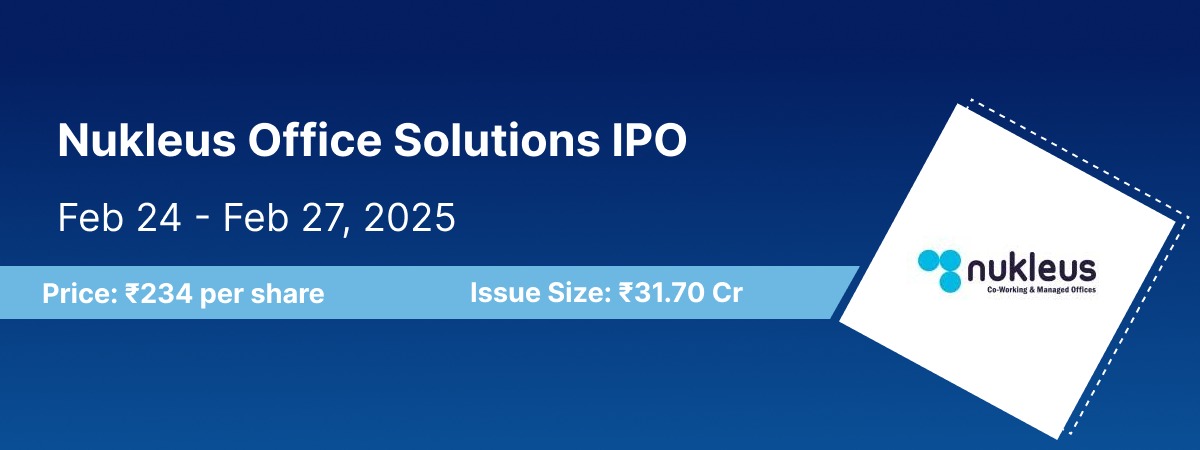

Nukleus Office Solutions is launching a fixed-price IPO worth ₹31.70 crores, consisting entirely of a fresh issue of 13.55 lakh shares.

The IPO opens for subscription on February 24, 2025, and closes on February 27, 2025. The allotment is expected to be finalized on February 28, 2025, with a tentative listing date on the BSE SME set for March 4, 2025.

The issue is priced at ₹234 per share, with a minimum application lot size of 600 shares. Retail investors must invest at least ₹1,40,400, while HNIs need a minimum of 2 lots (1,200 shares), amounting to ₹2,80,800.

Sundae Capital Advisors is the book-running lead manager, while Bigshare Services Pvt Ltd is the registrar. Nikunj Stock Brokers Limited is the market maker for the issue.

Refer to for detailed information.

Nukleus Office Solutions IPO Details

| IPO Date | February 24, 2025 to February 27, 2025 |

| Face Value | ₹10 per share |

| Issue Price | ₹234 per share |

| Lot Size | 600 Shares |

| Total Issue Size | 13,54,800 shares (aggregating up to ₹31.70 Cr) |

| Fresh Issue | 13,54,800 shares (aggregating up to ₹31.70 Cr) |

| Issue Type | Fixed Price Issue IPO |

| Listing At | BSE SME |

| Share Holding Pre Issue | 26,77,200 shares |

| Share Holding Post Issue | 40,32,000 shares |

| Market Maker Portion | 53,400 shares |

Nukleus Office Solutions IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Retail Shares Offered | 50% of the Net Issue |

| Other Shares Offered | 50% of the Net Issue |

Nukleus Office Solutions IPO Timeline

The Nukleus Office Solutions IPO will open for subscription on February 24, 2025, and close on February 27, 2025.

| IPO Open Date | Mon, Feb 24, 2025 |

| IPO Close Date | Thu, Feb 27, 2025 |

| Tentative Allotment | Fri, Feb 28, 2025 |

| Initiation of Refunds | Mon, Mar 3, 2025 |

| Credit of Shares to Demat | Mon, Mar 3, 2025 |

| Tentative Listing Date | Tue, Mar 4, 2025 |

| Cut-off time for UPI mandate confirmation | 5 PM on February 27, 2025 |

About Nukleus Office Solutions Limited

Incorporated in December 2019, Nukleus Office Solutions Limited specializes in co-working and managed office spaces across Delhi NCR, offering furnished and flexible workspaces, including dedicated desks, private cabins, meeting rooms, startup zones, and virtual offices.

The company caters to startups, SMEs, large enterprises, professionals, and entrepreneurs, providing fully serviced workspaces designed for teams ranging from 50 to 500 seats.

As of December 31, 2024, Nukleus Office Solutions operated 7 flexible workspaces and 4 managed offices in Delhi NCR, with a total of 2,796 seats and an 88.48% occupancy rate. The company employed 30 professionals across various departments.

FAQs on Nukleus Office Solutions Limited and Its IPO

What is Nukleus Office Solutions Limited?

Nukleus Office Solutions Limited is a provider of co-working and managed office spaces in Delhi NCR, offering furnished and flexible workspaces such as dedicated desks, private cabins, meeting rooms, startup zones, and virtual offices.

When was Nukleus Office Solutions incorporated?

The company was incorporated in December 2019

What types of businesses does Nukleus Office Solutions cater to?

The company serves startups, SMEs, large enterprises, professionals, and entrepreneurs by providing fully serviced office spaces.

How many workspaces does the company operate?

As of December 31, 2024, the company operates 7 flexible workspaces and 4 managed offices in Delhi NCR, with a total of 2,796 seats and an 88.48% occupancy rate.

How many employees does Nukleus Office Solutions have?

As of December 31, 2024, the company has 30 employees across various departments.

What is the size of the Nukleus Office Solutions IPO?

The IPO is a fixed-price issue of ₹31.70 crores, consisting entirely of a fresh issue of 13.55 lakh shares.

When does the Nukleus Office Solutions IPO open and close?

The IPO opens for subscription on February 24, 2025, and closes on February 27, 2025.

When is the allotment expected to be finalized?

The allotment for the IPO is expected to be finalized on February 28, 2025.

Where will Nukleus Office Solutions be listed?

The company will be listed on the BSE SME platform, with a tentative listing date of March 4, 2025.