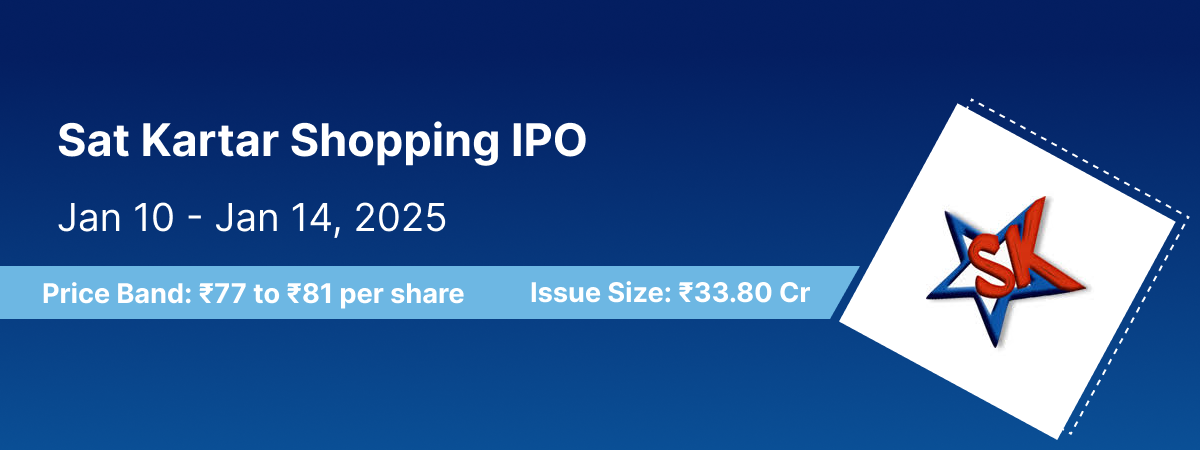

The Sat Kartar Shopping IPO is a book-built issue with a total size of ₹33.80 crores, comprising a fresh issue of 41.73 lakh shares. The IPO opens for subscription on January 10, 2025, and closes on January 14, 2025. Investors can expect the allotment finalization on January 15, 2025, while the tentative listing date is set for January 17, 2025. The shares will be listed on the NSE, SME platform, offering an opportunity for investors to trade in this emerging stock.

The IPO has a price band of ₹77 to ₹81 per share, with a minimum application lot size of 1,600 shares. Retail investors must invest at least ₹1,29,600, while high-net-worth investors (HNIs) need a minimum of 2 lots (3,200 shares), amounting to ₹2,59,200.

Narnolia Financial Services Ltd. is the book-running lead manager for the IPO, ensuring a smooth issuance process. Skyline Financial Services Private Ltd. serves as the registrar, and Prabhat Financial Services Ltd. is the market maker for this IPO.

This IPO offers a fresh investment opportunity for those looking to diversify their portfolio with a promising business. With a clear schedule and well-defined investment requirements, it caters to both retail and high-net-worth investors.

For comprehensive details, please refer to the Sat Kartar Shopping IPO Red Herring Prospectus (RHP).

Sat Kartar Shopping IPO Details

| IPO Date | January 10, 2025 to January 14, 2025 |

| Face Value | ₹10 per share |

| Price Band | ₹77 to ₹81 per share |

| Lot Size | 1,600 Shares |

| Total Issue Size | 41,72,800 shares (aggregating up to ₹33.80 Cr) |

| Fresh Issue | 41,72,800 shares (aggregating up to ₹ 33.80 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | NSE SME |

| Share Holding Pre Issue | 1,15,72,076 shares |

| Share Holding Post Issue | 1,57,44,876 shares |

| Market Maker Portion | 2,33,600 shares |

Sat Kartar Shopping IPO Timeline

The Sat Kartar Shopping IPO will be open for subscription from January 10, 2025, to January 14, 2025.

| IPO Open Date | Friday, January 10, 2025 |

| IPO Close Date | Tuesday, January 14, 2025 |

| Basis of Allotment | Wednesday, January 15, 2025 |

| Initiation of Refunds | Thursday, January 16, 2025 |

| Credit of Shares to Demat | Thursday, January 16, 2025 |

| Listing Date | Friday, January 17, 2025 |

Sat Kartar Shopping IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| QIB Shares Offered | Not more than 50% of the Net Issue |

| Retail Shares Offered | Not less than 35% of the Net Issue |

| NII (HNI) Shares Offered | Not Less than 15% of the Net Issue |

Sat Kartar Shopping IPO Lot Size

Investors can place bids starting with a minimum of 1,600 shares and in multiples thereof. The table below outlines the minimum and maximum investment requirements for retail investors and high-net-worth individuals (HNIs) in terms of shares and corresponding amounts.

| Application | Lots | Shares | Amount |

|---|---|---|---|

| Retail (Min) | 1 | 1600 | ₹1,29,600 |

| Retail (Max) | 1 | 1600 | ₹1,29,600 |

| HNI (Min) | 2 | 3,200 | ₹2,59,200 |

About Sat Kartar Shopping Limited

Incorporated in June 2012, Sat Kartar Shopping Limited is a fast-growing Ayurveda healthcare company dedicated to providing natural wellness solutions. The company focuses on offering therapeutic and lifestyle products inspired by traditional Ayurvedic practices, promoting a healthier and more balanced lifestyle.

Sat Kartar Shopping Limited delivers its products directly to consumers through various channels, including its own website, third-party e-commerce platforms, television marketing, and digital platforms like Google and Meta applications.

Product Categories

- Specific Problem-Led Niche Therapeutic Areas

The company focuses on specialized healthcare segments, addressing targeted health issues such as addiction, personal care, and general wellness. Popular products in this category include Addiction Killer and Liv Muztang. - Lifestyle-Led Curative Areas

These products address health concerns stemming from lifestyle challenges, such as diabetes, joint pain, piles, and other ailments.

In addition, the company is expanding its product range to include solutions for slimming, hair care, gut health, PCOD (Polycystic Ovary Disease), and mental wellness.

Workforce

As of November 30, 2024, Sat Kartar Shopping Limited employs 1,122 professionals working across various departments, ensuring smooth operations and growth.

Competitive Strengths

- Emerging Brand with PAN-India Presence: The company has established itself as a growing brand with reach across India.

- Asset-Light Business Model: A strategic approach that allows the company to maintain financial flexibility and scalability.

- Strong Digital Media Presence: Leveraging digital platforms for marketing and customer engagement.

- Customer Anonymity: Ensuring privacy and confidentiality for its customers.

- In-House Research and Development: Focused on innovation and product efficacy.

- Clinical Trials: Supporting product credibility and safety.

- Well-Structured Logistics Process: Ensuring efficient supply chain management.

Sat Kartar Shopping Limited continues to position itself as a leader in the Ayurveda healthcare space with its unique product offerings and strategic approach to growth.

FAQs for Sat Kartar Shopping IPO

What is the Sat Kartar Shopping IPO?

The Sat Kartar Shopping IPO is a book-built public issue comprising a fresh issue of 41.73 lakh equity shares, with a total issue size of ₹33.80 crores. It provides an opportunity for investors to participate in the company’s growth story.

When does the Sat Kartar Shopping IPO open and close for subscription?

The Sat Kartar Shopping IPO opens for subscription on January 10, 2025, and closes on January 14, 2025.

What is the price band for the Sat Kartar Shopping IPO?

The price band for the Sat Kartar Shopping IPO is set between ₹77 and ₹81 per share.

What is the minimum investment required for the Sat Kartar Shopping IPO?

Investors must bid for a minimum of 1,600 shares, which amounts to ₹1,29,600 at the upper price band.

What is the minimum lot size for the Sat Kartar Shopping IPO?

The minimum lot size for the Sat Kartar Shopping IPO is 1,600 shares, and bids can be placed in multiples thereof.

When will the allotment for the Sat Kartar Shopping IPO be finalized?

The allotment for the Sat Kartar Shopping IPO is expected to be finalized on January 15, 2025.

On which stock exchange will the Sat Kartar Shopping IPO be listed?

The Sat Kartar Shopping IPO shares will be listed on the NSE SME platform.

What is the tentative listing date for the Sat Kartar Shopping IPO?

The tentative listing date for the Sat Kartar Shopping IPO is January 17, 2025.