Upcoming IPOs in 2025: India’s IPO market in 2025 is poised for significant growth, with a slew of highly anticipated public offerings across sectors like technology, retail, healthcare, and manufacturing. This guide will provide an in-depth look into the most awaited IPOs in India, their potential impact on investors, and the industries they represent.

The year 2025 is poised to be a landmark period for Initial Public Offerings (IPOs), with several high-profile companies across various sectors preparing to go public. This comprehensive guide delves into the most anticipated IPOs, providing insights into each company’s background, market valuation, and the potential impact on investors and the broader market.

Upcoming IPOs in 2025

| IPO Name | Dates | Listing Date | Issue Size | Price Band | Lot Size | Listed on |

| Denta Water IPO | 22 to 24 Jan, 2025 | 29 Jan, 2025 | ₹220.50 Cr | ₹279 to ₹294 | 50 | BSE, NSE |

| Rexpro Enterprises IPO | 22 to 24 Jan, 2025 | 29 Jan, 2025 | ₹53.65 Cr | ₹145 | 1,000 | NSE, SME |

| Capital Numbers Infotech IPO | 20 to 22 Jan, 2025 | 27 Jan, 2025 | ₹169.37 Cr | ₹250 to ₹263 | 400 | BSE, SME |

| Stallion India IPO | 16 to 20 Jan, 2025 | 23 Jan, 2025 | ₹199.45 Cr | ₹85 to ₹90 | 165 | BSE, NSE |

| EMA Partners IPO | 17 to 21 Jan, 2025 | 24 Jan, 2025 | ₹76.01 Cr | ₹117 to ₹124 | 1,000 | NSE, SME |

| Land Immigration IPO | 16 to 20 Jan, 2025 | 23 Jan, 2025 | ₹40.32 Cr | ₹70 to ₹72 | 1,600 | BSE, SME |

| Laxmi Dental IPO | 13 to 15 Jan, 2025 | 20 Jan, 2025 | ₹698.06 Cr | ₹407 to ₹428 | 33 | BSE, NSE |

| Barflex Polyfilms IPO | 10 to 15 Jan, 2025 | 20 Jan, 2025 | ₹39.42 Cr | ₹57 to ₹60 | 2,000 | NSE, SME |

| Sat Kartar Shopping IPO | 10 to 14 Jan, 2025 | 17 Jan, 2025 | ₹33.80 Cr | ₹77 to ₹81 | 1,600 | NSE, SME |

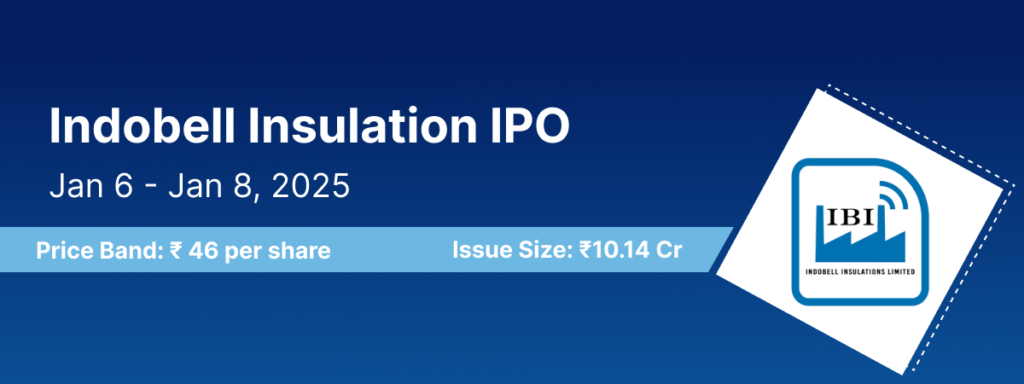

| Indobell Insulation IPO | 6 to 8 Jan, 2025 | 13 Jan, 2025 | ₹10.14 Cr | ₹46 | 3,000 | BSE, SME |

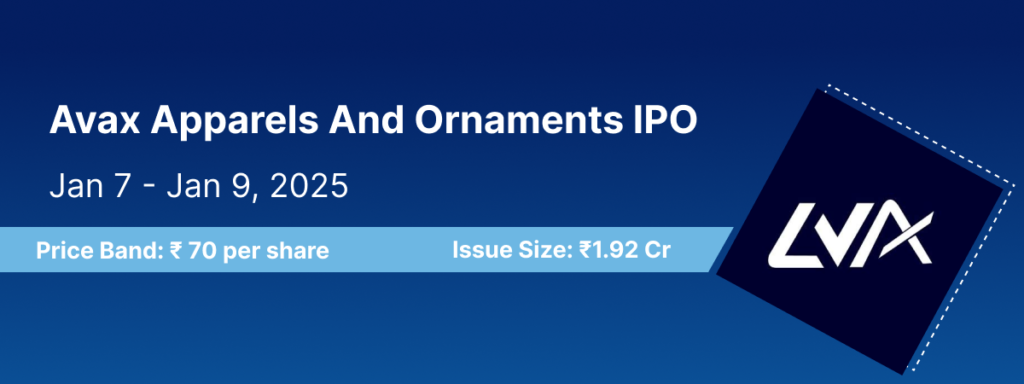

| Avax Apparels And Ornaments IPO | 7 to 9 Jan, 2025 | 14 Jan, 2025 | ₹1.92 Cr | ₹70 | 2,000 | BSE, SME |

| B R Goyal Infrastructure IPO | 7 to 9 Jan, 2025 | 14 Jan, 2025 | ₹85.21 Cr | ₹128 to ₹135 | 1,000 | BSE, SME |

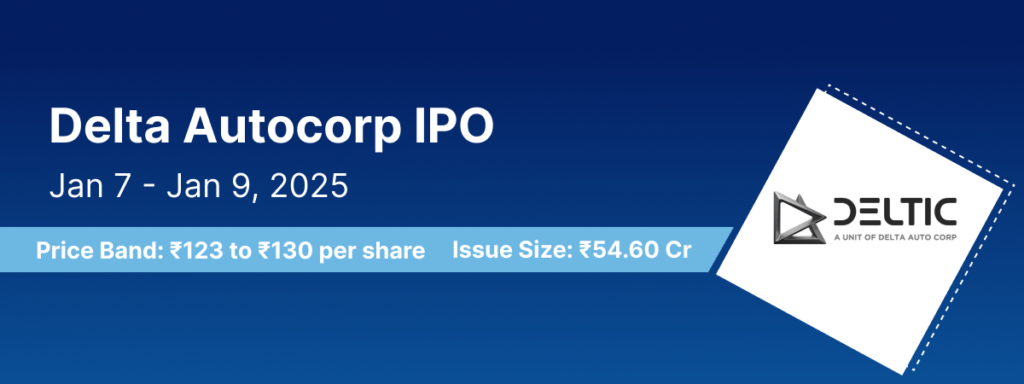

| Delta Autocorp IPO | 7 to 9 Jan, 2025 | 14 Jan, 2025 | ₹54.60 Cr | ₹123 to ₹130 | 1,000 | NSE, SME |

| Fabtech Technologies IPO | 3 to 7 Jan, 2025 | 10 Jan, 2025 | ₹27.74 Cr | ₹80 to ₹85 | 1,600 | BSE, SME |

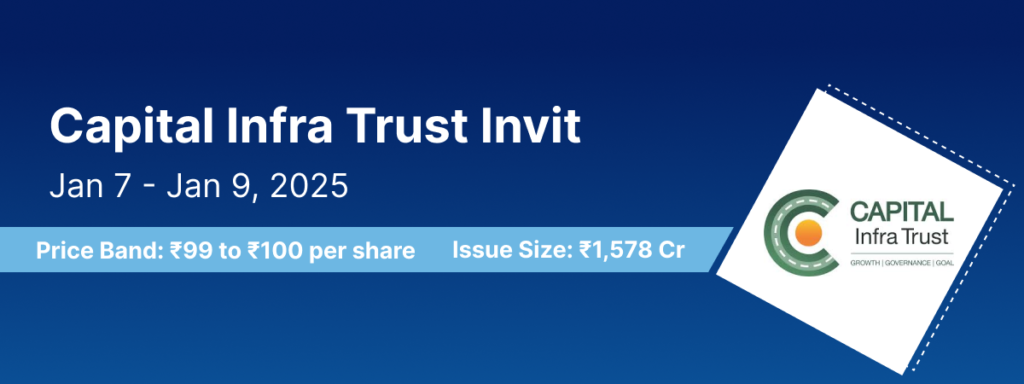

| Capital Infra Trust Invit | 7 to 9 Jan, 2025 | 14 Jan, 2025 | ₹1,578 Cr | ₹99 to ₹100 | 150 | BSE, NSE |

| Quadrant Future Tek IPO | 7 to 9 Jan, 2025 | 14 Jan, 2025 | ₹290 Cr | ₹275 to ₹290 | 50 | BSE, NSE |

| Standard Glass Lining IPO | 6 to 8 Jan, 2025 | 13 Jan, 2025 | ₹410.05 Cr | ₹133 to ₹140 | 107 | BSE, NSE |

The IPO market in 2025 is set to witness a resurgence, with companies from diverse industries aiming to capitalize on favorable market conditions. The previous years have seen fluctuating IPO activities due to economic uncertainties and market volatility. However, with increasing investor confidence and a stable economic outlook, 2025 is expected to be a pivotal year for companies seeking public listings.

India has been a hotbed for IPOs in recent years, with companies leveraging the strong capital market and growing investor appetite. In 2025, the IPO pipeline looks particularly promising, featuring diverse sectors that align with India’s economic growth and technological advancements.

The government’s focus on “Digital India” and self-reliance (Atmanirbhar Bharat) has further propelled industries to seek public funding for expansion. Here’s a detailed look at some of the most anticipated IPOs in India this year.

Technology IPOs in India 2025

1. Ather Energy IPO

Ather Energy’s Initial Public Offering (IPO) represents a pivotal milestone in the company’s journey to become a dominant player in India’s rapidly growing electric vehicle (EV) market. As one of the leading manufacturers of electric scooters in India, Ather Energy is strategically positioned to capitalize on the country’s transition to sustainable and eco-friendly transportation.

The Ather Energy IPO, aiming to raise ₹4,500 crore, is expected to fuel the company’s expansion plans. With the funds raised, Ather Energy will scale its manufacturing capabilities, broaden its product range, and enhance its market penetration. This move will help the company increase production capacity and meet the growing demand for electric two-wheelers in India.

Despite facing financial challenges, Ather Energy’s strong brand presence, market positioning, and commitment to innovation make it an attractive opportunity for investors looking to capitalize on the booming electric vehicle industry. The company’s successful growth trajectory, coupled with the increasing adoption of electric mobility solutions in India, places it at a strategic advantage.

As the Indian government continues to push for green energy and sustainable transportation solutions, Ather Energy is poised to benefit significantly from the evolving market dynamics. With its cutting-edge technology, strong market presence, and commitment to sustainability, Ather Energy is well-positioned to lead India’s electric mobility revolution. For investors, the Ather Energy IPO offers a promising opportunity to tap into one of the most exciting sectors of the Indian economy

2. BYJU’s IPO

EdTech giant BYJU’s is rumored to launch its IPO in 2025, targeting a valuation exceeding ₹50,000 crores. As one of the largest online education platforms in India, BYJU’s is expected to attract retail and institutional investors alike.

- Key Highlights: Market leader in EdTech with global expansion plans.

- Expected Valuation: ₹50,000 crores+

E-Commerce and Retail IPOs in India 2025

1. Zepto IPO

Zepto, a quick-commerce startup specializing in ultra-fast grocery deliveries, is set to go public in 2025. The company’s rapid growth and innovative business model have garnered significant attention.

- Focus Areas: Expanding its footprint in Tier 1 and Tier 2 cities.

- Expected Valuation: ₹7,000 crores

2. Snapdeal IPO

E-commerce platform Snapdeal, a competitor to Flipkart and Amazon, is aiming for a comeback with its IPO.

- Key Focus: Affordable online shopping for the mass market.

- Expected Valuation: ₹6,500 crores

Healthcare IPOs in India 2025

1. Sahajanand Medical Technologies IPO

A leader in the production of stents and other medical devices, Sahajanand Medical Technologies is preparing for its IPO.

- Expected Valuation: ₹5,000 crores

- Impact: Expansion in healthcare and medical device manufacturing.

Manufacturing and Energy Sector IPOs in 2025

1. Reliance Jio IPO

Reliance Jio, the telecom arm of Reliance Industries, is one of the most awaited IPOs in Indian history.

- Expected Valuation: ₹1,00,000 crores+

- Key Highlights: Dominance in the telecom sector and rapid expansion in 5G technology.

2. Tata Play IPO

Formerly known as Tata Sky, Tata Play is venturing into the public markets in 2025.

- Expected Valuation: ₹10,000 crores

- Core Strength: A well-established presence in the Indian entertainment and broadband market.

Financial Sector IPOs in 2025

1. NSE (National Stock Exchange) IPO

The NSE, India’s largest stock exchange, is planning its long-awaited IPO in 2025.

- Expected Valuation: ₹40,000 crores

- Key Features: Monopoly in stock trading and significant technological advancements.

2. SBI Mutual Fund IPO

India’s largest mutual fund house, SBI Mutual Fund, is expected to go public in 2025.

- Expected Valuation: ₹50,000 crores

- Key Strengths: Strong investor base and wide distribution network.

Other Notable IPOs in 2025

Apart from the major sectors, other notable IPOs in India include:

- FabIndia: Known for its ethnic clothing and sustainable products.

- OYO Rooms: The hospitality giant continues its IPO plans after previous delays.

- Mamaearth: A fast-growing D2C brand focusing on personal care and wellness.

How to Prepare for Investing in IPOs

Research and Due Diligence

Before investing, it is crucial to research the company’s financials, business model, and growth prospects.

Understand the Valuation

Evaluate whether the company’s valuation aligns with its market position and growth potential.

Assess Market Conditions

Monitor broader market trends and sector-specific developments that might influence the IPO performance.

Diversify Investments

Avoid over-concentration by diversifying across sectors and companies.

Conclusion

The year 2025 is set to redefine India’s IPO landscape, offering investors a plethora of opportunities across diverse sectors. From technology to healthcare and retail, the upcoming IPOs reflect the dynamic nature of India’s economy. With proper research and a cautious approach, investors can leverage these public offerings to build a robust investment portfolio.

Stay updated with the latest IPO news and prepare to capitalize on India’s growing market potential.

FAQs on Upcoming IPOs in 2025

What is an IPO?

An IPO (Initial Public Offering) is the process through which a private company offers its shares to the public for the first time, allowing investors to purchase ownership in the company.

Why are IPOs important for companies?

Why are IPOs important for companies?

Which are the most anticipated IPOs in India in 2025?

Some of the most awaited IPOs in India for 2025 include:

- NSE (National Stock Exchange)

- Reliance Jio

- Ola Electric

- Zepto

Are IPO investments risky?

Yes, IPO investments carry risks. While they can offer high returns, factors like overvaluation, market volatility, and company performance may affect stock prices post-listing.

What is the grey market, and why is it important in IPOs?

The grey market refers to an unofficial market where IPO shares are traded before listing. Grey market premiums (GMP) can provide an indication of demand and expected listing gains, though they are not always accurate predictors.

What is a draft red herring prospectus (DRHP)?

The DRHP is a preliminary document filed by a company with SEBI, providing detailed information about the company, its finances, business model, and risks associated with the IPO.

What is the lock-in period for IPO shares?

For retail investors, there is typically no lock-in period. However, promoters and anchor investors may have a lock-in period as mandated by SEBI (Securities and Exchange Board of India).

Which sectors dominate the IPO market in 2025?

In 2025, key sectors driving IPOs in India include:

- Financial Services

- Technology and Fintech

- Electric Vehicles (EV)

- Healthcare and Pharma

- E-commerce and Retail